The last two years have seen turmoil in many economic areas but the world crude oil market has been particularly hit. In terms of strategy there was a particular extremely fascinating development that influenced many other events. It was the new stance demonstrated by the key player – Saudi Arabia – and its several close allies. Saudi Arabia’s production strategy changed at least three times, which is quite unusual for such a short period of time. Moreover, it was really stunning to see this frequent attitude change from a producer widely considered the steadying force of the market.

So what engendered such behavior? Why would the bulwark of stability depart from its predictable approach?

Episode 1: Taking One for the Team

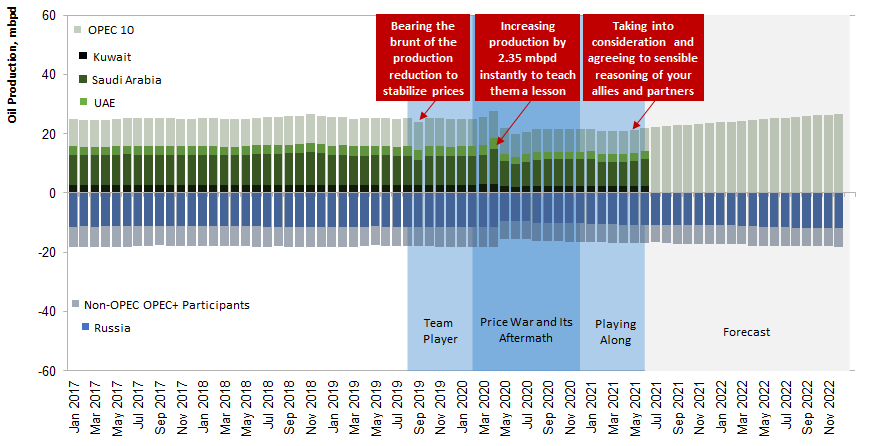

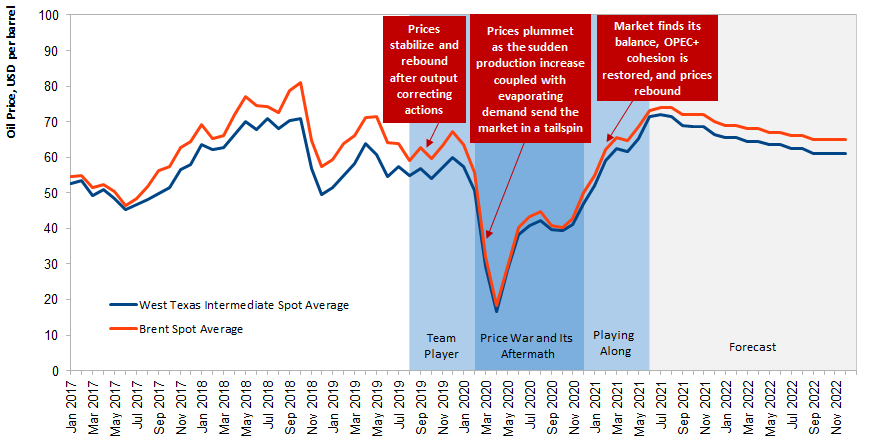

The recent tumultuous episode started in mid-2019 with a fall in prices and collective action by OPEC+ to deal with this fall. It can be seen in the charts below that Saudi Arabia significantly reduced its crude production while the other key players kept theirs intact.

Basically, Saudi Arabia agreed to take the hit virtually alone in order to stabilize the market and keep the nascent OPEC+ alive and running. This lone action was enough to keep the oil price from falling further, and by the end of 2019 prices started growing again.

Episode 2: The Price War and Its Aftermath

The situation changed drastically in early 2020. The COVID-19 pandemic became a real and acute threat to the health of the world economy. People and businesses were coming under the lockdowns all over the world. As a result, the demand for most commodities, and most notably oil, was evaporating quickly.

The advised solution was quite straightforward: reduce output and do it rapidly. Nevertheless, some participants of the OPEC+ could not be persuaded. Even before it had been discussed for months that Russia was free-riding the cartel’s previous agreements to limit production. In March 2020 it became evident that Russia did not want to abide by the proposed new reduction action.

This was when Saudi Arabia’s strategy changed radically and decisively. The price war was started. Saudi Arabia, Kuwait, and United Arab Emirates (UAE) virtually overnight expanded production by 2.35 million barrels per day (mbpd) on a falling market. Oil prices plummeted. Traders panicked. In some cases to avoid actual delivery, they were ready to pay others to get rid of that crude in tankers moving to the port. These were the days when even the general public learned that oil prices can be negative.

Emotions ran high at the time but Saudi Arabia’s confrontational strategy worked. OPEC+ convened an emergency meeting and agreed to substantial production cuts. Moreover, Saudi Arabia’s normal level of production (the one from which curbs are calculated) was increased from 9 mbpd to 11 mbpd, while Russia’s was lowered. Conformity levels (the term used by OPEC to describe abiding by the agreed levels of output) improved. Subsequently, world oil production went down, prices stabilized and later rebounded.

Episode 3: Playing along Again?

The most recent transformation in Saudi Arabia’s strategy can be seen in the last several months. After OPEC+ returned back to collaboration and adhering to the promised output levels, the unity in the cartel seemed restored.

And yet some frictions still arise. For example, just in July 2021 Kuwait did not want to agree to the earlier set pace of exiting from the production cuts. They wanted to produce more. Talks ensued. It was agreed that Kuwait would get what it wanted.

But at the same time other countries with spare capacity – Russia and Saudi Arabia – got their base production levels increased. The easy-to-miss nuance in this decision: Saudi Arabia can play along with your demands but now they want their part of the deal and their share of the market on the other part of the scale.

Note 1: OPEC and the US Energy Information Administration (EIA) use different definitions of oil production. Most notably EIA includes condensate in non-OPEC oil production. More discussion on the differences can be found here and here.

Note 2: Here in order to avoid complications the EIA’s forecast for production and prices is presented.

Note 3: OPEC 10 are Algeria, Angola, Congo, Equatorial Guinea, Gabon, Iraq, Kuwait, Nigeria, Saudi Arabia, UAE. Non-OPEC members of OPEC+ are Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, Sudan, South Sudan.

Note 4: Data for the oil production of the non-OPEC participants of the OPEC+ presented here does not include output of Bahrain (baseline production 0.2 mbpd), Brunei (0.1 mbpd), and Sudan (less than 0.1 mbpd).